No one likes payroll errors! Failing to pay an employee, or paying employees incorrectly comes with a whole slew of problems. Dips in morale, a negative impact on retention, and even possible legal consequences. Fortunately, most payroll errors can be avoided with a few simple steps. Follow along for our 6 tips to run perfect payroll, every time!

1. Make all employee changes before you start payroll

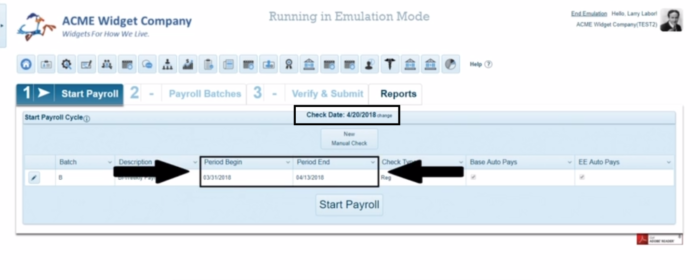

This is a big one! When you click “Start Payroll”, our platform grabs all of the employee data currently in the system to populate your payroll batch with. That means your list of active employees, pay rates, deductions, etc.

To make sure your payroll batch is as up-to-date as possible, be sure to make any rate changes, earning/deduction/tax changes, and add/terminate employees before starting payroll.

2. Verify your check date and pay periods are correct. Also, that they are at least 2 business days before you’re processing!

Before starting payroll, always verify your check date and pay period are correct. To make sure employees are paid on time and taxes are deposited in compliance with IRS deadlines, your deadline to submit payroll is 2 business days before your check date by 2 PM PT.

If you need to change your check date, you can do so by selecting “Change” next to your Check Date on the Start Payroll page.

It may be obvious, but also make sure you’re not processing any check dates in the past. Unfortunately, paying employees for a past check date isn’t as simple as writing a different date on a check. If your employee is paid via direct deposit, this will result in late payment. More importantly, processing a check date in the past causes late taxes, which can result in penalties and interest.

If you have a situation where you forgot to pay an employee in the past, give our team a call and we can walk you through your options!

3. Double-check your imports

If you’re importing hours from a timekeeping system, get in the habit of always comparing your imported hours to a source document. While imports generally run smoothly, data anomalies or errors as minute as a misspelled column header or incorrect comma can result in import complications.

Top Tip: If you’re using SDP’s timekeeping system, you can compare your imported hours to the Summary Report in your Timekeeping Supervisor module to make sure these match.

4. Review new direct deposits

If you’ve made any changes to employee direct deposits for this payroll run, you should also double-check these before processing. Data entry errors are very common when entering bank account information.

Unfortunately, little can be done after payroll is processed if direct deposit is sent to the wrong bank account, so always double-check this information. As the old adage goes, “it’s always better to measure twice and cut once.”

Top Tip: To reduce your risk of data entry errors, you can set employee direct deposit information to be editable by the employee pending approval from management. That way, the employee is the one keying in the information. You can inform employees to provide you a voided check so you can verify the bank information prior to approving the change for an added level of security!

5. Check your pre-process report thoroughly… Before submitting!

Next, always check your pre-process register. While the Comparative Analysis screen is good for catching big errors, this register provides employee-level detail and our IT department will need it if troubleshooting payroll errors. When reviewing your pre-process report, you should look at individual employee earnings, deductions, and taxes, as well as confirm that all employees are being paid that need to be.

6. Make your payroll grid work for you

Our system has so many great features and configurable settings to improve your payroll processing experience. Take advantage of them to decrease errors and speed up the time it takes to process payroll. Check out the short video below for our team’s tips to optimize your pay grid to streamline you payroll process!

Let’s Talk

Ready to become a payroll pro? Comment below which of these tips is your favorite! If you’re not already on our SDP Connect platform, then let us know! If you’re already processing payroll with Southland Data Processing, we’d be happy to upgrade you to our enhanced platform for free. And if you’re not already an SDP client, we’d love to learn more about your business to see if we could help save you time or money with the payroll and HR side of your business.

Lastly, don’t forget to follow us on Facebook, Twitter, and LinkedIn for even more business tips & news!

Photo by Andrea Piacquadio from Pexels