In response to a nationwide retirement crisis, many states are rolling out their own retirement plans. Joining the ranks of Oregon, Illinois, and others in releasing a state-sponsored IRA savings program, California Senate Bill 1234 officially mandated that all California employers with 5+ employees offer a retirement savings plan.

The CalSavers program is one option for employers who do not currently offer a retirement plan. However, it’s important to consider all available options before deciding.

So with the deadline fast approaching for employers with 50+ employees to offer a retirement plan (June 30, 2021!), read on for everything you need to know about Calsavers and your options to comply with SB 1234.

What is CalSavers?

The CalSavers Program is designed to help your employees save for retirement via payroll contributions to a state-sponsored retirement plan. It gives employees the option of either using default account options or personalizing the plan with their own contribution rate and investments. Additionally, CalSavers even has an automatic increase option to increase employees’ savings by 1% each year until their savings rate reaches 8%.

By default, these accounts are Roth (post-tax) IRAs. In 2021, the contribution limits are $6,000 per year to a Roth IRA (and $7,000 per year when you are age 50 or older) as long as you earn at least $6,000 in wages.

While this originally meant that employees with higher incomes were not eligible to contribute, CalSavers now offers savers the option to recharacterize their contributions to a Traditional IRA in their online portal or by contacting Client Services.

Eligible Employers

If you have at least five California-based employees, at least one of whom is age eighteen, and don’t sponsor a qualified retirement plan, your business is required to register for CalSavers. The three-year phased rollout began on September 30, 2020, with staggered registration deadlines based on each business’ employee count:

- 100+ employees: September 30, 2020. (Extended from June 30, 2020)

- 50+ employees: June 30, 2021.

- 5+ employees: June 30, 2022.

Business Size

To calculate your business size for eligibility and compliance deadlines, use the average number of employees you report to the Employment Development Department (EDD) on your previous four DE9C filings.

Nonprofits

The requirements are the same for non-profit and for-profit employers. According to Calsavers, volunteers who are not considered employees under state law are not eligible and will not be included in counting a non-profit employer’s number of employees.

Religious Organizations

Religious organizations are exempt from the CalSavers requirement.

Employee Eligibility

For employers who choose to offer Calsavers, any employee who is 18 or older and has the status of an employee under California law, receives a W-2, or is a sole proprietor or partner in a partnership that is an eligible employer, is likely to be eligible to participate in the Program subject to California law and the federal rules governing Roth IRAs.

However, due to the 30 day notification period (employee contributions do not begin until the first payroll following this period), some (very) short-term employees may not be able to make contributions.

Employer Responsibilities

Throughout the roll-out, eligible employers will be notified by CalSavers when it’s time for them to register. Then, you’ll just need to gather three pieces of information to get started:

- Federal Employer Identification or Tax Identification Number (EIN/TIN).

- CA Employer Payroll Tax Account Number.

- CalSavers access code from your notification.

Do I have to offer CalSavers?

Nope! CalSavers is one way to satisfy requirements and help employees save for retirement. However, it’s in businesses’ best interest to compare it with other financial options and decide which option is best for them and their employees.

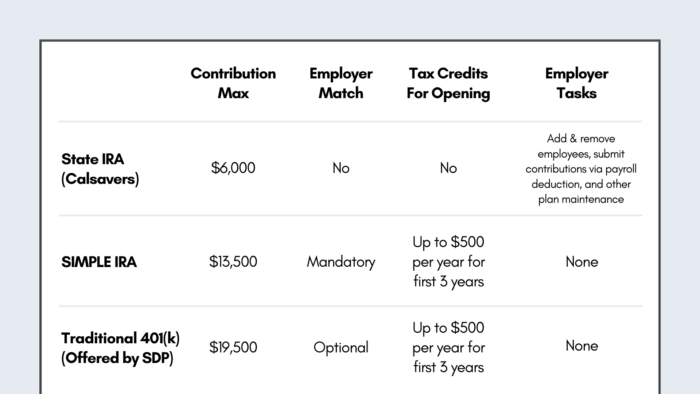

To illustrate, the chart below shows key characteristics of a state-run IRA compared to a SIMPLE IRA and 401(k) plan, both of which Southland Data Processing offers. In either case, the biggest differences are the option for a company to match a portion of savers’ contributions, and the maximum amount employees can contribute.

As seen above, although the State IRA may be a great fit for some businesses, it won’t be the best option for others. For example, due to the contribution max of $6,000, many employers whose employees would like to contribute more may find this limit problematic. Additionally, employers who want to be more competitive to job seekers may want an option that allows them to provide a company match.

Another big advantage of a 401(k) plan is that it is pre-tax. Further, employers can claim tax credits for opening a new plan as with the SIMPLE IRA. Although ultimately each business will need to decide the best solution for their own needs, we strongly encourage you to weigh out all your options before committing to one!

What’s the cost?

If you do select CalSavers as your retirement plan option, there is no employer fee for participating in the program. However, you could face financial penalties for not having CalSavers or another retirement savings plan available by your deadline (based on employer size, above).

Under the new requirement, each eligible employer that (without good cause) fails to allow its eligible employees to participate in CalSavers will incur a minimum penalty of $250 per eligible employee if noncompliance extends 90+ days after receiving a notice of failure to comply. Further, employers found to be still out of compliance 180+ days after the notice will incur an additional penalty of $500 per eligible employee.

What else do I need to do?

As an eligible employer, you are responsible for:

- First, registering for the program.

- Second, providing basic employee roster information for eligible employees. Specifically, employee names, dates of birth, Social Security Numbers or ITINs, and contact information.

- Then, facilitating by payroll deduction the appropriate contributions each pay cycle.

- Finally, conducting ongoing maintenance. For example, submitting employees’ contributions, adding new employees, and removing employees who have left your company.

And that’s it! Typically, the registration process should only take about 30 minutes. However, many employers complete their registration in 15 minutes or less.

After registering and submitting your employee data, CalSavers will contact your employees directly to make them aware of the program and provide the opt-out or customization options. Then the ball’s in their court!

Employee Responsibilities

Under state law, CalSavers is an “automatic enrollment program”. In other words, eligible employees who do not actively choose to opt out will be enrolled automatically in the program.

Essentially, if employees do not act within 30 days of notification that their employer has registered for the program, they will be automatically enrolled at the default savings rate. In addition to this, your employees should know:

- Contributions will be made via payroll deduction.

- The default savings rate is 5% of gross pay.

- They have the option to customize their plan and choose a different rate. Also, they can change this rate at any time.

- Employees can opt back in to the program at any time.

- Even if they leave their job, their account stays with them.

Let’s Talk

Even though navigating through these laws can be tricky, don’t forget SDP is here to help keep you compliant. For more information on the CalSavers program, you can visit their website here. Additionally, to explore Southland Data Processing’s retirement solutions, let us know to get in touch with a member of our team to learn how our customizable plans can be tailored to meet your specific business needs.