In December 2020, the COVID-related Tax Relief Act of 2020 made amendments to the Families First Coronavirus Response Act (FFCRA). The new changes provide small and midsize employers refundable tax credits. Specifically, these credits reimburse employers, dollar-for-dollar, for the cost of providing paid sick and family leave wages to their employees for leave related to COVID-19.

We know that for many of our clients, business slowdowns related to the spread of COVID-19 have made it hard to imagine how they could bear any additional expenses. So read on to learn how you can take advantage of FFCRA tax credits to relieve some of that burden!

Key Points

- To take immediate advantage of the FFCRA paid leave tax credits, businesses can retain and access funds that they would otherwise pay to the IRS in payroll taxes.

- If the amount of the credit exceeds the employer portion of federal employment taxes, then the excess is treated as an overpayment and refunded to the employer under sections 6402(a) or 6413(a) of the Code. Employers can file Form F7200 to request an advance (refund) for their excess credits, or they can wait until their 941 is filed.

- SDP clients who file any Forms F7200 will also need to complete our Advance Payment 7200 Credit Form so we can reflect this on your quarterly returns.

- There is no retroactive application, so credits will not be applied to any leave paid out before April 1.

- Credits for emergency paid leave codes apply to Federal taxes only.

Payroll Setup

Beginning April 1st, clients will begin entering paid sick leave amounts into special earning codes in payroll. These codes are:

- EPLSick (ER Paid Leave Sick)

- EPLCare (ER Paid Leave Dependent Care)

- EPLChild (Emergency Paid Leave Child Care).

Please note that SDP has to set up these codes on your behalf, and the only way to receive tax credits for the FFCRA paid sick leave is to use the codes set up by SDP. Any other codes used will not trigger a tax credit.

To request your new paid sick leave code setup, please complete the “FFCRA Leave Code Request Form” in the “Downloads” section of our COVID-19 Business Resource Hub and email it to [email protected]. You must submit these requests 3 business days prior to the processing deadline for the payroll you would like the codes to take effect in.

After this, SDP will automatically reduce your next federal tax deposit by the amount paid to employees through these codes.

EPL Credits On Your Payroll Reports

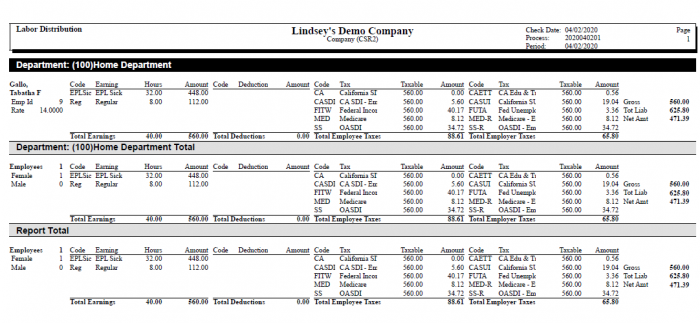

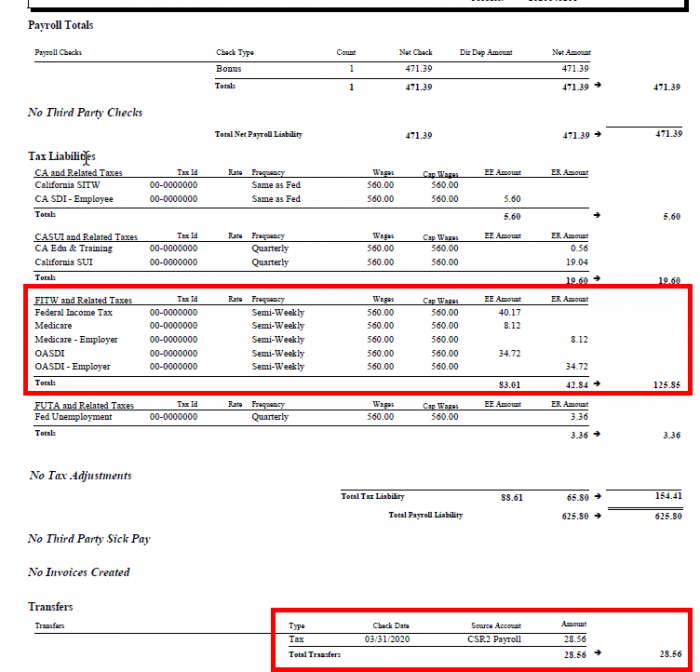

Federal taxes will be calculated and displayed as they normally would on all payroll registers and distribution reports.

However, the amount of the transfer on the payroll summary will be reduced by the amount of the credit. (There will not be a line on the report that explicitly displays a “credit”.)

Future Updates

We know that the weeks to come will bring unexpected challenges for our business community due to the Coronavirus. However, we are here to support your business through these challenges. Additionally, we will continue to provide ongoing communications as more details unfold.

Finally, if you have any questions or concerns, please feel free to contact us at (866) 946.2032 or by emailing our support team. And don’t forget to follow us out on Facebook, Twitter, and LinkedIn for even more Coronavirus and business updates!