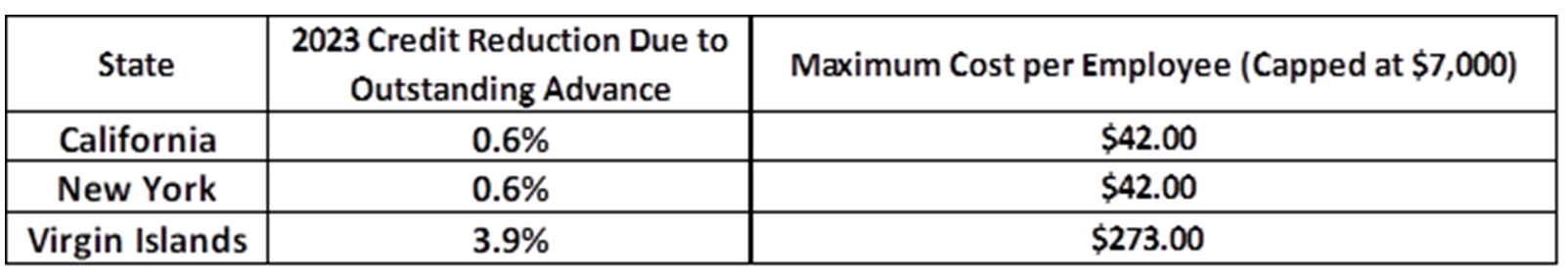

Plan For Additional Tax Payments in January 2024 if you have employees in the following states:

*The additional cost per employee listed above is based on the FUTA wage limit of $7,000. If an employee earned less than $7,000 in 2023, their taxable wages will be multiplied by the FUTA Credit Reduction rate to determine the additional cost.

After your final payroll for 2023 is processed, SDP will reconcile and automatically calculate any additional 2023 FUTA tax due. You will receive a written notification in early January 2024 indicating the amount of additional FUTA liabilities that SDP will collect and pay to the IRS as part of the 940 filing for tax year 2023. Please have available funds in your account on or before January 15th, 2023. In addition, there will fee of $60 added to your Payroll Invoice for each federal ID that is subject to the FUTA Credit Reduction.

What is FUTA Credit Reduction (FCR)?

Contrary to popular belief, the default rate for Federal Unemployment Tax (FUTA) is not 0.6%. The actual FUTA base rate is 6%. However, the IRS allows employers to receive a credit of up to 5.4% if their FUTA liability is paid timely.

Some states don’t have enough money to cover their unemployment benefits. When this happens, the state borrows money from the federal government to fund their unemployment programs. States have now had three years to pay back their loan. If they have an outstanding balance on their Title XII Advance as of November 10, the federal government reduces the amount of the FUTA tax credit. This means that until the loan is repaid, every company with employees in that state pays more in FUTA taxes.

Due to the impact of the unprecedented COVID-19 crisis, California, New York and the Virgin Islands have had an outstanding federal loan balance for three consecutive years. As a result, employers will have to pay an additional 0.6% on wages paid in 2023 to employees for work attributed to any of these states. This is an additional Increase of 0.03% from 2022.

Next Steps:

- After your final payroll for 2023 is processed, SDP will reconcile and automatically calculate any additional 2023 FUTA tax due.

- You will receive a written notification in early January 2024 indicating the amount of additional FUTA liabilities that SDP will collect and pay to the IRS as part of the 940 filing for tax year 2023.

- Please have available funds in your account on or before January 15th, 2023. In addition, there will fee of $60 for each federal ID that is subject to the FUTA credit reduction.

FAQs

Am I being penalized for layoffs during the pandemic?

No. FUTA credit reductions are not assessed because of the activity of individual employers. The state failed to pay back a federal loan within the prescribed period, therefore every company with employees in that state must pay more in FUTA taxes until the loan is paid in full.

Why didn’t SDP calculate taxes at a higher rate throughout the year?

States have been given three years to repay their Federal Title XII loan. The IRS does not announce which states are subject to the FUTA credit reduction until November 10th of each year.

What happens if I do not pay the additional amount?

If the full amount of FUTA tax due is not paid on time employers will receive an amount due notice from the IRS and incur penalty and interest (depending on when the payment is made the interest rate will be as high as 15% of the total liability).

Will this happen again next year?

At this time we do not know. If these states fail to successfully repay their loans by November 10, 2024 the FUTA Credit Reduction rate will increase to 0.9%.

Additional Resources:

- IRS — Federal Unemployment Tax

- IRS — FUTA Credit Reduction

- IRS — Form 940 Filing Requirements

- Department of Labor — FUTA Credit Reductions

- IRS Video – FUTA Credit Reduction

For the latest updates, follow us on LinkedIn, Facebook, Twitter, YouTube, Instagram and TikTok for even more business tips and news.

*Southland Data Processing, Inc. (“SDP”) is not a law firm. This article is intended for informational purposes only and should not be relied upon in reaching a conclusion in a particular area of law. Applicability of the legal principles discussed may differ substantially in individual situations. Receipt of this or any other SDP materials does not create an attorney-client relationship. SDP is not responsible for any inadvertent errors that may occur in the publishing process.